CONSUMER RESOURCES

Resources for buying or selling a home, property taxes, and more.

THINKING OF BUYING A HOME ON YOUR OWN?

Here's Your To-Do List

Get Informed - Do Your Research

- Research the real estate industry and legal services to understand what’s available to you, including the entire process and necessity for legal representation.

- Achieve proficiency in federal and state fair housing laws that protect your rights. You want to be sure that you’re not being denied the opportunity to make an offer on a home or secure financing based on your race, religion, national origin, sex, disability, and/or family status.

- Research local and national down payment assistance resources. These programs can help make your home purchase more affordable.

- Check your eligibility for down payment assistance programs.

- If you’re a Veteran, research home services and loan programs available to you.

- If you’re a Veteran, determine whether you qualify for a zero-down VA home loan. Making a down payment is a significant hurdle for many home buyers. Programs like these can open the door to homeownership, for those who know about them and qualify.

- Learn about local home prices, inventory levels, and market demand in your desired area. If you are in a hotter market, high demand for homes may affect your buying process and offer strategy.

- Ensure that all personal and financial information remains confidential to mitigate risk of identity theft. Research the steps that you can take to protect your identity when buying a home.

- Throughout the process, know the risks of posting home search details on social media to avoid being targeted for fraud.

- Do some research on what home features are currently popular to help identify your preferences and how this may affect the value of the home.

Set Homeownership Goals and Budget

- Obtain a copy of your credit report, including your credit score, to assess where you stand, and ensure you have time to dispute errors and improve your score. The better your credit score, the more likely you are to be approved for a mortgage and receive a better rate.

- Consider all your homeownership wants and non-negotiable needs. You may need a certain number of bedrooms based on the size of your family, or a first-floor bedroom and bathroom if you plan to age in place.

- Set your budget and be mindful of the complete cost of homeownership. Consider the purchase cost of the home and any ongoing living and maintenance expenses. Those ongoing expenses may include but are not limited to real estate taxes, heating, AC, water, yard and appliance maintenance, repairs, homeowners association fees, and commuting costs.

- Assess your financial ability to purchase a home. The typical rule of thumb is that your total monthly housing payment (mortgage, taxes, insurance, etc.) shouldn’t be more than 30% of your gross monthly household income, but individual situations may vary.

- Assess your desired market’s compatibility with your budget based on current income and other considerations.

- Professionally advocate for yourself throughout the entire process. To do that, you should promote and defend your interests while keeping emotions in check to ensure you get your desired outcome.

Start Your Home Search

- Establish and adhere to a schedule for house hunting, mortgage approval, and closing to meet your desired timeline. If you miss any milestone deadlines, you could be at risk of losing your down payment or losing the home for purchase.

- Learn how local markets could affect your buying and owning process. Fewer homes for sale, future development plans, school ratings, access to transportation, and community amenities are all elements that may affect demand in a given market.

- Scout listings and online marketplaces for suitable properties.

- Set up real-time alerts on home search marketplaces to get notifications when matching homes hit the market, and for open houses and price reductions.

- Compare properties to your wants and needs list to ensure they align with what you’re looking for.

- Tap your personal network to uncover additional properties of interest that are not yet publicly listed and may become available for sale soon.

- Contact homeowners in desired areas to see if they are considering selling.

- Gather information about any homes that might be for sale but are not actively being marketed.

- Virtually preview properties that you’re interested in.

- Select homes for viewing that align with your specific needs.

- Schedule multiple in-person home viewings by contacting each home’s listing agent. Schedule separate appointments at times that suit the listing agent but may not always suit you.

- Periodically reevaluate your needs and refocus your property search, as necessary.

- Explore all available resources to learn more about prospective neighborhoods. Be sure to speak to local experts who understand the neighborhood and will give you honest feedback.

- Tour the amenities, schools, and points of interest, and test commute times in your chosen search area.

- Cross-reference local crime registries for the neighborhoods you are searching.

- Educate yourself on what to look for in property disclosures of home listings while you search to make informed decisions. Required property disclosures vary by state and may include, but are not limited to rights of way, upcoming special assessments, whether the home is in a flood zone, past termite damage, and the presence of lead paint.

- Stay current with the listing months of market inventory. As with days on the market, this indicates how competitive a given market is and should inform your offer.

- Consider measures of home value beyond price per square foot. These include neighborhood, proximity to work and community amenities, and community development plans. Be sure to consult with a local expert to get the most comprehensive information.

- Research municipal services and other relevant neighborhood information.

- Be informed about potential neighborhood negatives such as noise levels, venues, or operations that could impact your property value.

- Check applicable zoning and building restrictions if you plan to rent out your home or add a unit to generate short-term or monthly rental income.

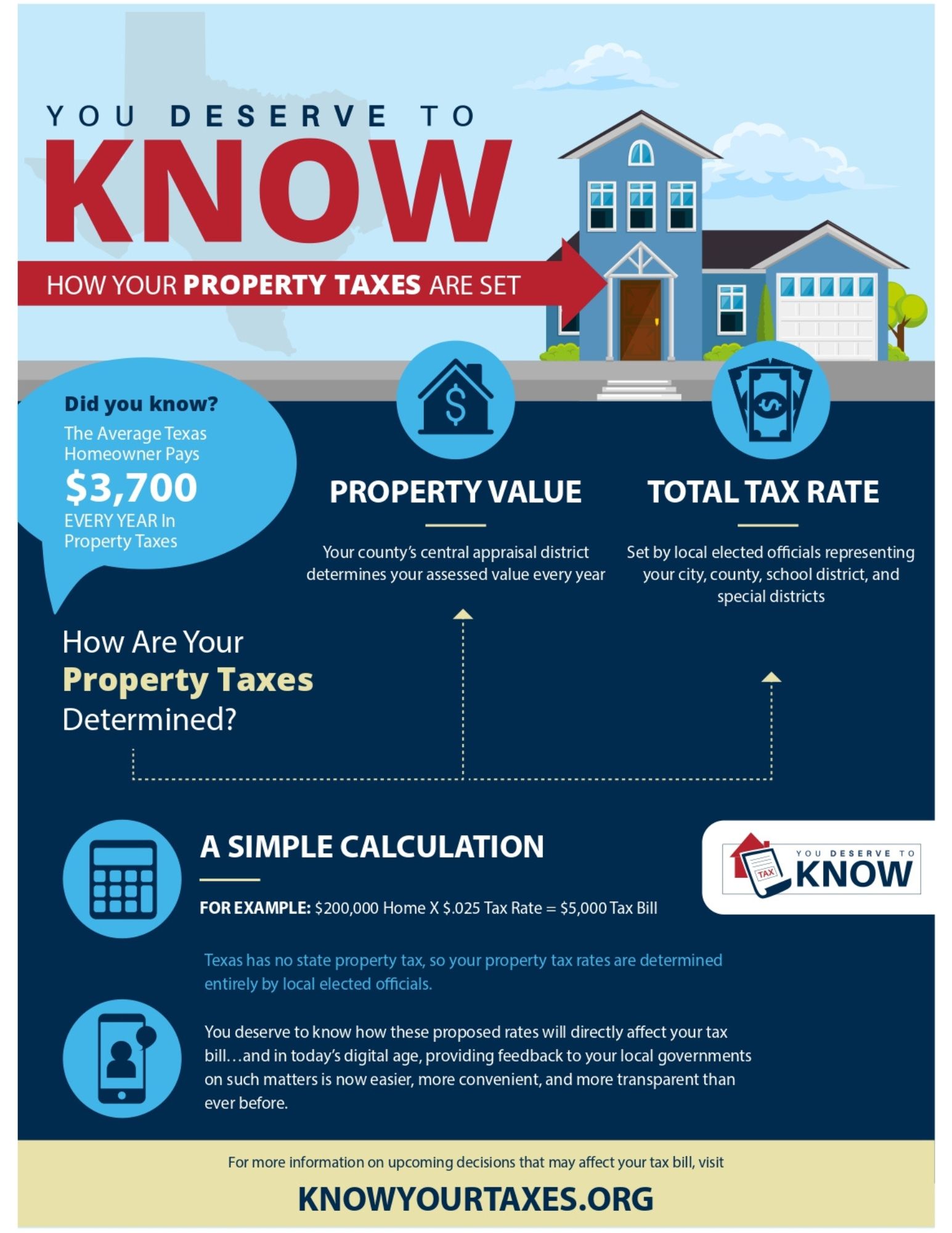

- Understand public property and tax information for potential homes. It’s important to be informed about the possibility of future tax increases and property assessments, which will affect the property taxes you owe from year to year.

- Gather and consider important data on utility availability and costs. For example, you’ll want to confirm if the home has good high-speed internet access.

- Research any environmental factors and risks that could affect your home, such as flooding, wildfire, heat, air quality, and noise. Some of these factors will affect the cost of ownership. For example, if the home you purchase is in a flood zone, you will need to obtain flood insurance.

- Narrow down your top home choices for a closer look before considering making any offer.

Prepare Financing

- Analyze your finances to determine the total down payment and closing costs you can afford.

- Gather and assess quality lender resources. Ask friends and family for recommendations.

- Consider at least three mortgage lenders during the pre-approval process. Mortgage rates, terms, and eligibility may vary from lender to lender.

- Familiarize yourself with the mortgage pre-approval process. Pre-approval means that a lender has verified your income, credit background, and other factors and has provided a conditional commitment for an approved mortgage amount. With pre-approval, your offer will be considered far more seriously.

- Prepare and collect personal financial information like pay stubs, credit card statements, and other existing loans/debt, and share that information with the lenders you’re considering.

- Collect and compare multiple financing options. Beyond traditional mortgages, look into lesser-known alternative options like seller financing or rent-to-own programs.

- Explore various financing options to find the best fit for your needs. Many people use a conventional, fixed-rate 30-year mortgage, but mortgages with other terms (e.g., 15- and 10-year fixed rate, adjustable rate, and assumable) might also be options.

- Coordinate with your lender to discuss discount points, which you can pay to lower the interest rate on your loan.

- Analyze loan estimates. Loan duration, size of your down payment, fees, and other loan terms can affect your overall mortgage costs.

- Obtain a pre-approval letter from your lender, which is more comprehensive than pre-qualification. Pre-approval is a written commitment from a lender that stipulates the amount they will lend you for a home purchase.

- Carefully review the pre-approval letter from your lender to understand its contents and ask necessary questions.

Making Your Offer

- Review statistics to see what percentage of the list price sellers in your area are currently receiving. Review recent sales to see how long homes like the one you want are staying on the market.

- Leverage available resources to negotiate with the seller. You’ll want to be sure that you’ve found all possible information about the home and are making a strong offer.

- Review available inspection data before making an offer. Inspections are your opportunity to uncover issues with the property that you may not have noticed during your home search.

- Submit a strong offer backed by market research to make sure you’re offering a competitive price.

- Consider adding a personalized letter to your offer. This could help set you apart and make your offer stand out from others.

- Include contingencies in your offer that protect you in case the deal falls through. Examples of contingencies are obtaining financing, selling your current home, satisfactory home inspection, and completing the sale by a certain date. You’ll want to work with your real estate professional to understand your options for contingencies and whether they will make your offer more or less appealing to the seller.

- Be sure to respond to counteroffers in a timely manner. Consider them carefully and strategically.

- Remain flexible in negotiations to increase your chances of a successful offer. For example, being open to closing on the seller’s timeline might make your offer more appealing.

- Stay informed throughout the negotiation process to ensure you understand the contract and meet all deadlines. For example, you’ll need to ensure you understand the terms of the contract, respond to counteroffers in a timely manner, and prepare to meet any contingencies you’ve set.

Closing the Deal

- Secure an inspection as soon as possible after signing the purchase agreement to reveal any potential issues with the property.

- Consider hiring a professional for the inspection. While a professional inspection may cost several hundred dollars, it can reveal hidden issues that may be costly to fix later.

- After the inspection, negotiate repairs or credits with the seller if necessary. You can ask the seller to make the repairs or ask for credits or price reductions to cover the costs of repairs.

- Final review and approval of your financing application with your lender.

- Work with your lender to complete the home appraisal to determine the value of the home. The lender will order the appraisal, which usually costs several hundred dollars. The appraisal must be completed before the lender can approve your loan.

- After the appraisal, work with your lender to finalize the terms of your mortgage. The lender will review the appraisal, verify your income, and complete any other necessary steps to finalize your mortgage.

- Coordinate with your real estate professional, lender, and title company to ensure all necessary paperwork is completed before the closing date. This will include the closing disclosure, which lists the final terms and costs of your mortgage.

- Conduct a final walk-through of the home to ensure it’s in the expected condition and any agreed-upon repairs have been made. This usually takes place a few days before the closing date.

- Review the closing disclosure carefully and ask questions about any terms or costs you don’t understand.

- Be sure to bring all necessary documents and funds to the closing meeting. This includes a valid ID, proof of homeowner’s insurance, and a cashier’s check or wire transfer for the down payment and closing costs.

- Sign all closing documents, including the mortgage note, deed of trust, and other necessary paperwork.

- Receive the keys to your new home and celebrate your successful purchase!

Actual services or to-dos will depend on the needs of the buyer and the transaction - not all 111 things will need to be done in every transaction. Information based on a 2023 proprietary survey among recent home buyers and sellers. Provided in partnership with realtor.com.

WHY HIRE A REALTOR®?

Before you enter the world of real estate on your own, see if a REALTOR® can help you instead. Here are some reasons why you should reach out to a REALTOR®.

REALTORS® Are Held to a Higher Ethical Standard

Not all real estate agents are REALTORS®. REALTORS® pledge to abide by a Code of Ethics that goes beyond what’s required by law, keeping your interests first and setting high standards for professional behavior.

Read the REALTOR® Code of Ethics

If you believe a REALTOR® has violated the Code of Ethics, you can file a complaint.

REALTORS® Do More Than Help You Buy and Sell Real Estate

They protect the rights of property owners. They fight proposals that would increase the burdens on buying, selling, and owning real estate. And they bring property-owners’ concerns to the Legislature, regulatory agencies, and local authorities.

Learn more about how Texas REALTORS® advocate on your behalf.

REALTORS® Have Access to Specialized Education and Resources

In addition to the hundreds of classroom hours required to hold a real estate license, Texas REALTORS® take advantage of continuing educational opportunities to stay up-to-date on industry trends and developments. Many Texas REALTORS® also undertake specialized training to better serve subsets of consumers, shown by the letters that often follow their names (known as designations or certifications).

Through their association, REALTORS® also have exclusive access to more than 100 forms related to real estate activity, making your transaction go smoothly and saving time.

REALTORS® Know How to Accurately Price a Home

While you could use a home-valuation website that tells you a number, you shouldn’t rely on it alone. These sites often don’t know the details of your property, the current market, and what buyers are looking for in your area. A REALTOR® can help you determine a more accurate price for your property.

REALTORS® Can Narrow Your Home Search

You could spend hours and hours searching for properties online, contacting owners or their agents to see the property, and figuring out whether it’s a good deal. Or, you could hire a REALTOR® to cut through the clutter by determining your needs, finding properties that fit those parameters for you, and setting up tours to see them. On top of that, they can help you figure out if the price is right and what you can afford.

REALTORS® Are Skilled Negotiators

Not everyone is skilled at negotiations, but REALTORS® are. They’re armed with the most up-to-date information about laws, the market, and more that puts them in a position to negotiate on your behalf with confidence.

REALTORS® Manage the Process and Save You Time

REALTORS® can save you a lot of time and hassles by handling the tasks you don’t have time to manage. For example, REALTORS® have experience marketing properties, which means you don’t have to come up with a plan on your own. They also facilitate and explain the entire transaction process so you don’t have to keep track of every single detail.

CONSUMER GUIDES

Real estate transactions can be complicated. These guides can help.

Written Buyer Agreements

When searching for a home, you will be asked to sign a written buyer agreement after you’ve chosen the professional you want to work with.

Open Houses and Written Agreements

Real estate professionals nationwide will be asking buyers to enter into a written agreement prior to touring a home. But what if you are just attending an open house?

Negotiating Written Buyer Agreements

Here's what to know about negotiating an agreement for services and compensation with an agent who is a REALTOR®.

Offers of Compensation

Here's what to know about a seller or agent offering to compensate another agent for bringing a buyer to successfully close the transaction.

Listing Agreements

One of the first things you'll do when selling your home is negotiate and sign a listing agreement with your agent.

Multiple Listing Services

When buying or selling a home, your agent may use an MLS to find homes for sale or market your property. Here's what you need to know.

Seller Concessions

Home sellers may choose to offer concessions to attract buyers or close a deal. Find out if this approach is right for you.

Buying Your First Home

You’re ready to find your first home. Find out where to begin and what resources are available to you as you embark on your homeownership journey.

Mortgages and Financing

An agent who is a REALTOR® can help you learn about options for finding a loan that will help you pay for your new home over time.

10 Questions to Ask a Buyer's Agent

If you’re ready to buy a home, you should feel empowered to find and work with the agent who is the best fit for your needs.

10 Questions to Ask a Seller's Agent

If you’re ready to sell your home, you should feel empowered to find and work with the agent who is the best fit for your needs.

Steps Between Signing and Closing

Once you sign a purchase agreement on your new home, there are still several steps to complete before you can finalize—or “close”—the transaction.

ADDITIONAL GUIDES

Purpose of Property Taxes

Your property tax dollars are used to fund community services such as:

- Public schools

- Infrastructure projects

- Police and fire departments

- And other local services

The tax rates set by local elected officials at your school district, county commissioners court, and city council every year help determine how much your property tax bill will be.

Homestead Exemptions

A homeowner is entitled to a homestead exemption on a property that is the homeowner's primary household starting from at least January 1 of the appraisal year. Contact your county’s central appraisal district for information about exemptions.

QUICK LINKS

Stay informed on current trends and topics affecting real estate as we interview local and industry guests. Watch an episode, or stream the audio when you're on the go.

View current and historical market data down to the local level. Our reports contain graphs and easy-to-understand data to quickly provide an overview of the current market.

Every summer, we grant 7 current college students a $2,000 scholarship. Unlike other scholarships, we award the students a check that they can use as they please.

Applications are open to immediate family of HLAoR members and local community members. Learn more.